Not surprisingly there was both uncertainty and skepsis on Sri Lanka when it became known that a foreign company few had heard of was taking over Ceylon Oxygen Company on the outskirts of the capital, Columbo.

The Sri Lankan government had started nationalizing all foreign-owned industry in the 1970s, including Ceylon Oxygen, which was British-owned at the time. Nationalization was not, however, particularly lucrative; the World Bank came on the scene with a number of requirements and a more specific list of companies that should be privatized. One of these was Ceylon Oxygen.

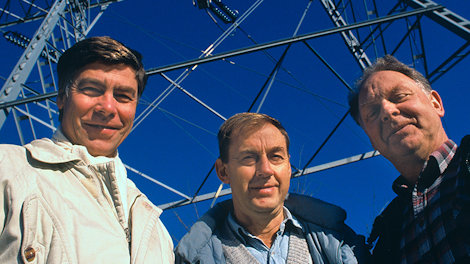

At this time the head of Hydrogas, Jon Reutz, happened to meet a businessman interested in Ceylon Oxygen at a conference in Oslo. Not long after, Jon Reutz and his colleague Alvin Rosvoll were on a plane to Columbo.

From red to black

The skepsis soon dissolved as investments streamed in and the plants were upgraded. Øystein Rødseth was put in charge, and the figures changed from red to black. But first there were challenges to face. One of these was bringing the number of employees down to an appropriate level.

Employees were offered the opportunity of resigning in return for significant compensation, but it was the company that decided who would be allowed to accept. “We wanted to keep the best people. The authorities later applauded the way the manning reduction had been organized through a voluntary system,” reminisces Rødseth.

Popular shares

The authorities also fixed the distribution of shares so that Hydro retained 60 per cent, 10 per cent were available for employees and 30 per cent were offered for subscription. The share issue was oversubscribed by a factor of five, and the Ceylon Oxygen share became one of the most popular on the Columbo stock exchange.

This is how Rødseth explains Hydrogas’ success in the takeover of Ceylon Oxygen: “Improvements were implemented in all areas. Financial and insurance costs were reduced, the manning level was lowered, and production efficiency was significantly boosted without increasing input factors. As a result, the company was soon running at a profit, and has continued to do so ever since.”

Only one department was enlarged – the marketing department. Under the previous owner, and particularly during the company’s period of state ownership, the sales personnel just sat in their offices and waited for customers to contact them. This was possible in a monopoly situation. However after Hydrogas came into the picture, everyone was involved in creating growth and improving service and distribution.

The largest enterprise on the customer list was Columbo Dockyard, which had a high consumption of welding gases. The food industry, from major breweries to catering companies and fish exporters also needed gas; and medical gases were supplied to hospitals.

Expansion

The most critical plants were the production units for oxygen and nitrogen. They were 50 years old, the standard was poor, maintenance irregular and production unreliable.

In 1998, Hydro gas opened a new air separation plant worth NOK 50 million. The new plant played an important part in boosting Ceylon Oxygen’s production capacity for oxygen and nitrogen. Production capacity nearly doubled, rising to 1,000 cubic meters of oxygen and nitrogen per hour. Opportunities also arose for selling liquid products for use in new technologies.

Ceylon Oxygen became known as an innovative and bold operation. The company was already well known locally, and over the years has delivered strong results in a difficult market.

More plants

Hydrogas expanded further on the other side of the Indian Ocean, through the purchase of a new greenfield carbon dioxide plant in Terengganu on the east coast of Malaysia. The plant, which opened in March 1999, delivers carbon dioxide to the food industry and bottling plants for fizzy drinks. The raw material carbon dioxide is supplied by Petronas, which was thus helped to solve a local environmental problem.

When Hydro Asia Pacific acquired 50 per cent of the new CO2 plant Santa Morrison in Thailand, Hydrogas was assigned to take care of a production and supply network for liquid CO2.

The market in Thailand has grown fast and is now as large as the French market. Hydrogas has increased its market share to over 10 per cent and has specialized in the freezing of foods such as tiger prawns.

Updated: 18 August 2020